San Diego Home Insurance - The Facts

San Diego Home Insurance - The Facts

Blog Article

Safeguard Your Home and Loved Ones With Affordable Home Insurance Plans

Relevance of Affordable Home Insurance Policy

Protecting economical home insurance is important for protecting one's building and economic health. Home insurance coverage offers defense versus numerous threats such as fire, burglary, all-natural disasters, and personal responsibility. By having a comprehensive insurance coverage strategy in place, homeowners can feel confident that their most considerable investment is protected in case of unanticipated scenarios.

Cost effective home insurance policy not just gives economic safety however likewise supplies comfort (San Diego Home Insurance). In the face of rising home values and building prices, having an affordable insurance coverage makes sure that property owners can quickly rebuild or repair their homes without encountering substantial monetary problems

In addition, affordable home insurance can additionally cover individual items within the home, supplying compensation for products harmed or swiped. This insurance coverage prolongs past the physical framework of the home, securing the materials that make a residence a home.

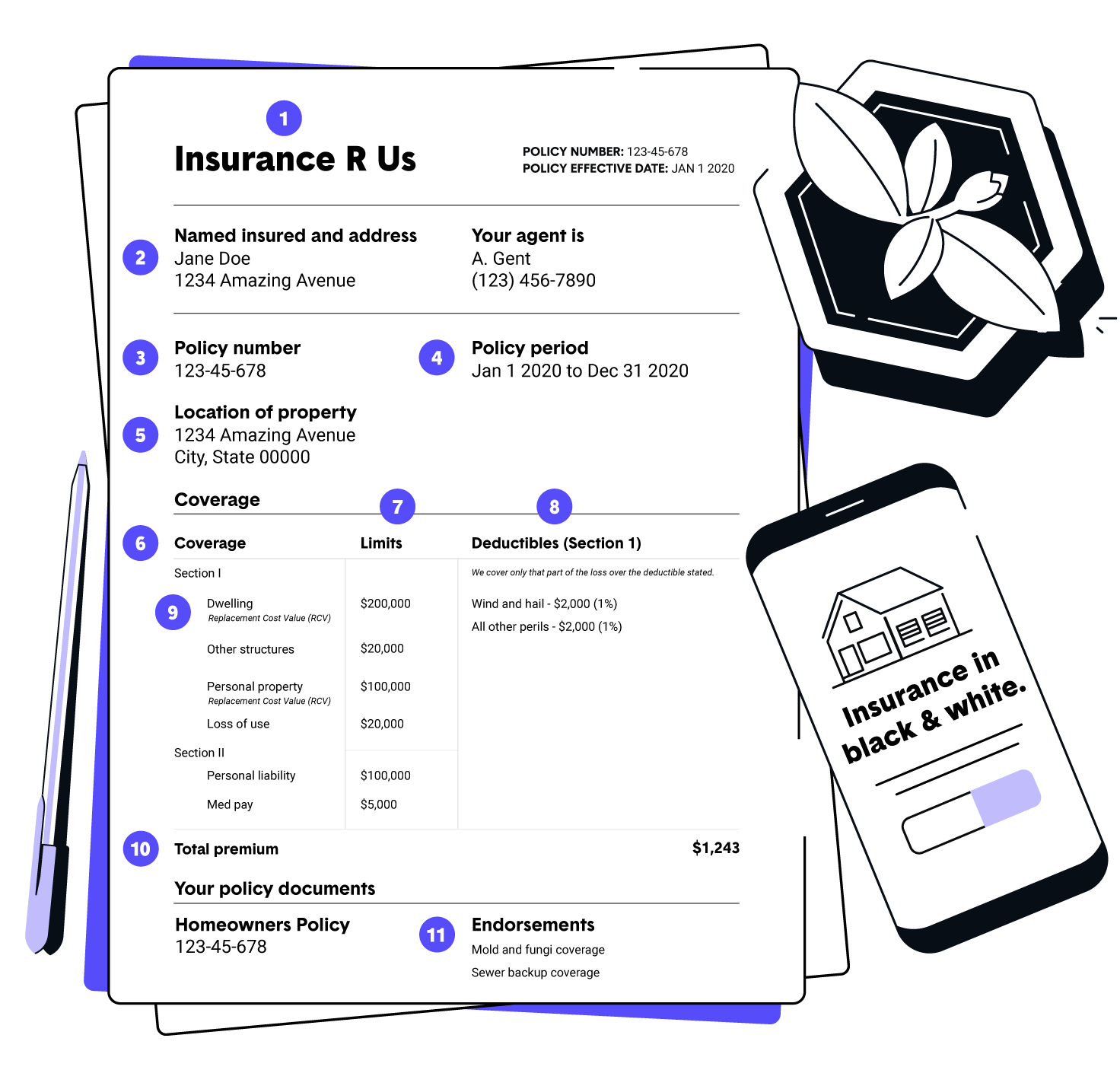

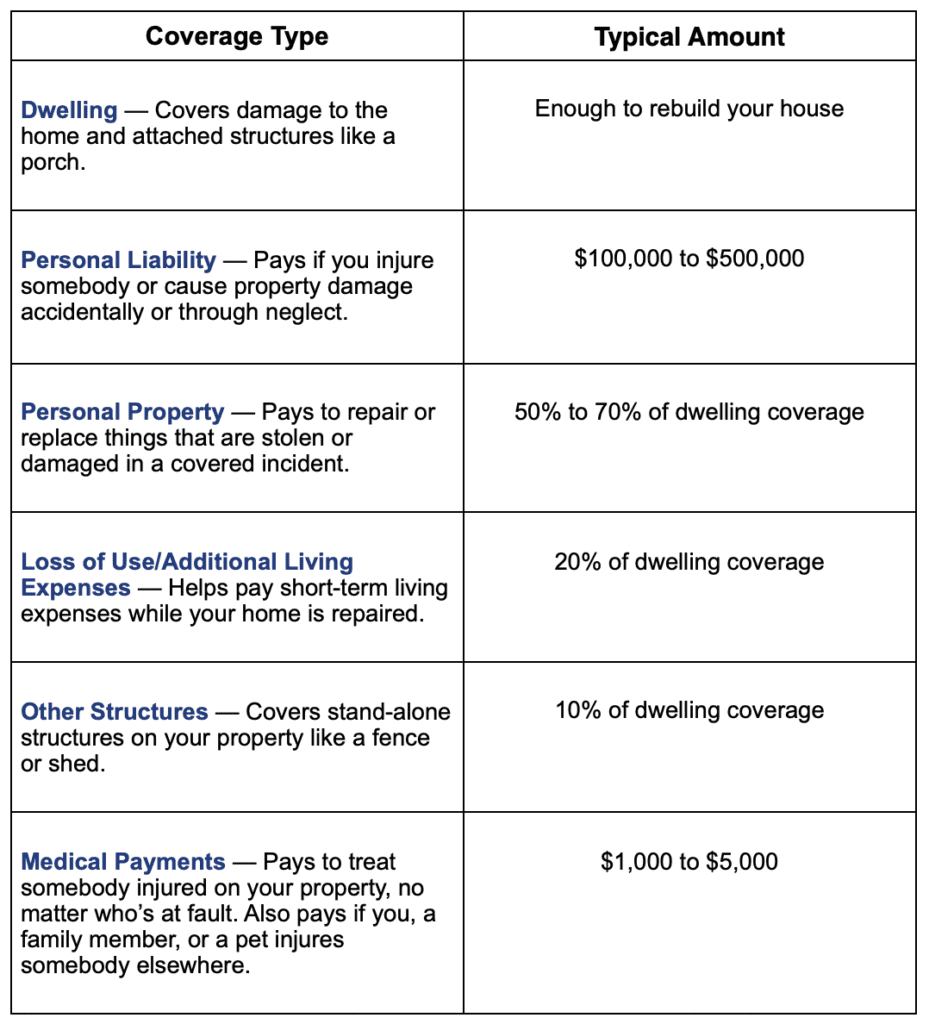

Coverage Options and Purviews

When it pertains to coverage limitations, it's important to understand the optimum amount your plan will pay out for each and every sort of protection. These limitations can vary depending upon the plan and insurance provider, so it's necessary to examine them carefully to guarantee you have sufficient defense for your home and assets. By recognizing the coverage choices and limits of your home insurance plan, you can make informed decisions to protect your home and liked ones effectively.

Aspects Affecting Insurance Coverage Expenses

A number of variables substantially affect the expenses of home insurance policies. The area of your home plays a vital duty in identifying the insurance policy costs.

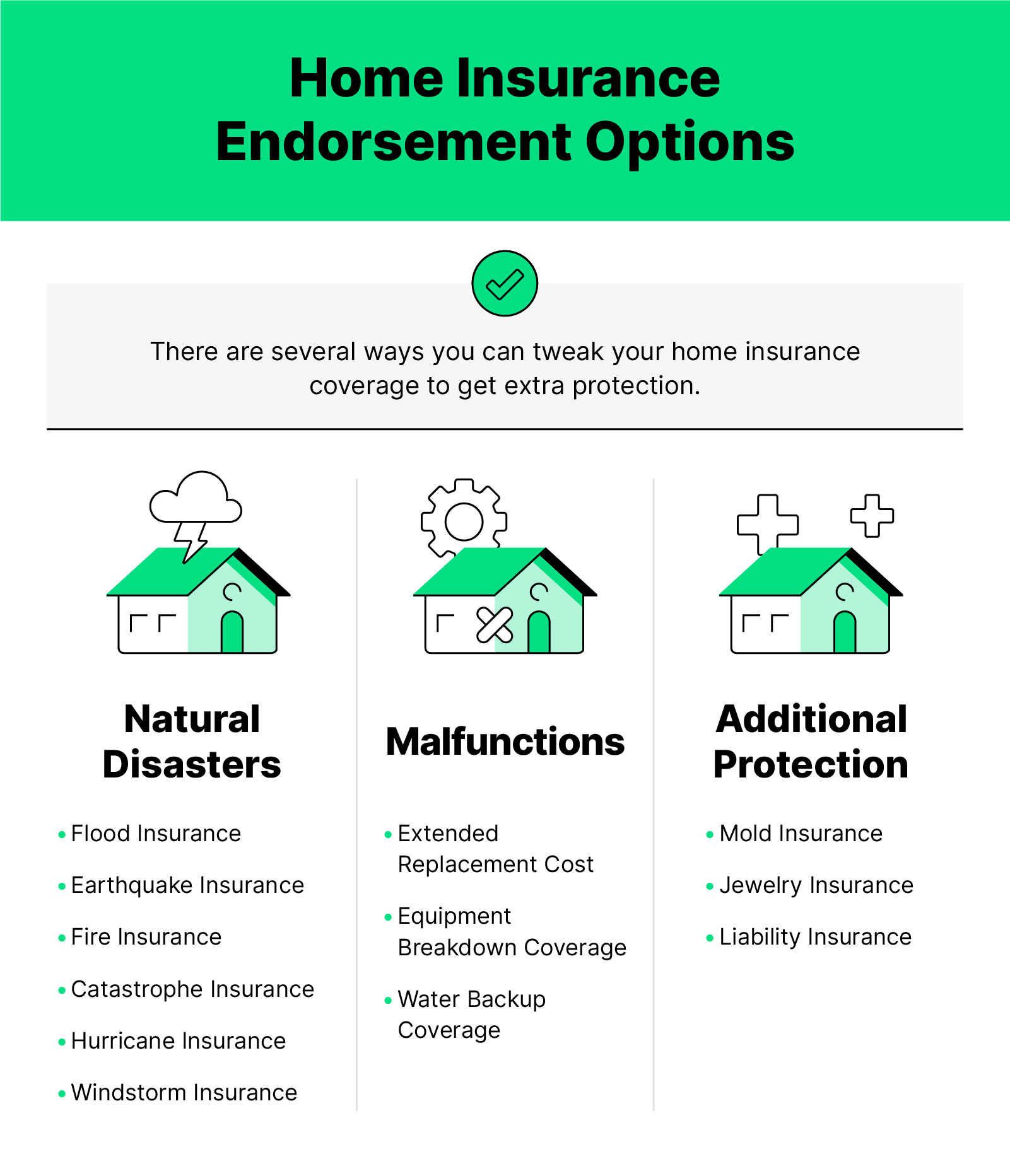

In addition, the type of protection you pick directly affects the cost of your insurance coverage policy. Opting for added insurance coverage options such as flood insurance policy or quake insurance coverage will boost your premium.

Furthermore, your credit history, claims history, and the insurance policy business you choose can all affect the price of your home insurance coverage policy. By taking into consideration these aspects, you can make enlightened choices to aid manage your insurance policy costs efficiently.

Comparing Quotes and Suppliers

Along with comparing quotes, it is crucial to examine the online reputation and financial security of the insurance policy service providers. Look for client testimonials, ratings from independent firms, and any history of problems or regulative actions. A reliable insurance supplier need to have an excellent record of immediately processing cases and supplying excellent client service.

Moreover, take into consideration the certain protection functions provided by each provider. Some insurance firms might offer added benefits such as identification theft protection, tools break down coverage, or coverage for high-value things. By very carefully comparing carriers and quotes, you can make an educated choice and pick the home insurance coverage plan that ideal satisfies your needs.

Tips for Reducing Home Insurance Coverage

After thoroughly contrasting quotes and suppliers to discover the most suitable protection for your needs and spending plan, it is prudent to discover effective methods for saving browse around these guys on home insurance policy. Several insurance companies supply discounts if you buy several policies from them, such as integrating your home and vehicle insurance policy. On a regular basis examining and upgrading your plan to reflect any kind of adjustments in your home or conditions can ensure you are not paying for protection you no longer need, aiding you conserve cash on your home insurance policy premiums.

Verdict

Finally, securing your home and liked ones with budget friendly home insurance coverage is critical. Comprehending coverage limits, aspects, and options affecting insurance coverage costs can help you make informed choices. By contrasting companies and index quotes, you can discover the very best plan that fits your needs and budget plan. Executing suggestions for conserving on home insurance can additionally aid you safeguard the necessary security for your home without damaging the financial institution.

By unwinding the ins and outs of home insurance plans and discovering functional methods for protecting inexpensive protection, you can make sure that your home and loved ones are well-protected.

Home insurance policies usually supply several coverage options to shield your home and belongings - San Diego Home Insurance. By comprehending the coverage alternatives and limitations of your home insurance policy, you can make enlightened decisions to safeguard your home and liked ones properly

Routinely reviewing and updating your policy to show any type of modifications in your home or scenarios can guarantee you are not paying for insurance coverage you no longer demand, aiding you conserve cash on your home insurance policy premiums.

In final thought, guarding your home and loved ones with inexpensive home insurance is essential.

Report this page